How we analyse brand vs non-brand organic revenue

Custom metrics as built by Blink SEO.

Since 2011, Google has stopped showing keyword referral data in Analytics, ostensibly on “privacy grounds”. Whether or not this has anything to do with privacy rather than pushing people to spend more on Google Ads is beside the point – the fact remains that the data most people see when they look at a referring keywords reports will be dominated by (not provided).

This creates a real blind spot for many businesses, particularly those in the DTC space where brand visibility is often an important factor in SEO performance. Without a clear idea of the split between brand and non-brand traffic, it can be muddy when it comes to knowing how your SEO campaigns are performing, or if they are at all.

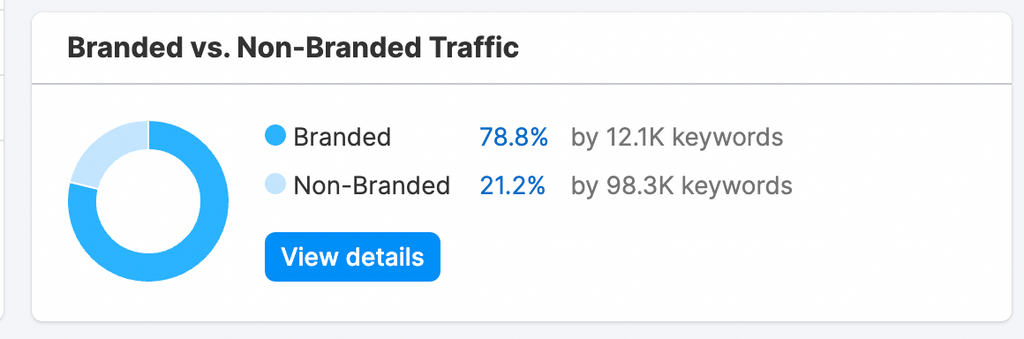

There are some existing ways to get around this, of course. SEMrush estimates branded and non-branded traffic as part of its Domain Overview report. Below is an example from Gymshark, one of the world’s best-known DTC brands.

This is fine, but it’s an estimate – it doesn’t give you any idea of real traffic volumes. Any idea of revenue is completely missing too. For market analysis, it’s a useful resource for sure, but for measuring performance for your own site, it falls well short.

Our solution

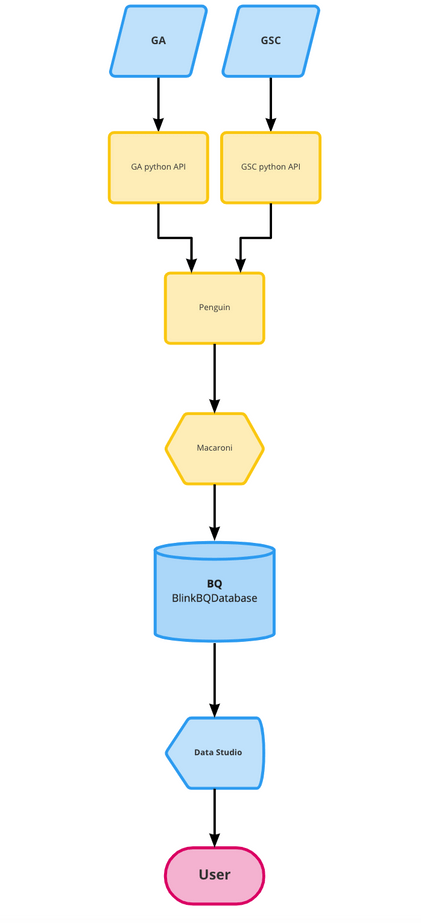

As an SEO, using Google Search Console web interface is both inefficient and frustrating, given that Google limits the data you can download to a spreadsheet at one time.

Because of this, we now use our own software (written in Python and utilising Google’s APIs) to store all our clients’ Search Console and Analytics data in a BigQuery cloud database. This has the amazing side effect of allowing us to synthesise the two data sources, as well as adding custom dimensions and metrics that meet the needs of our SEO team.

One custom dimension we add to our Search Console data – alongside “keyword” – is “branded”, a true/false value calculated automatically by establishing whether the keyword is a close-enough match to the client’s brand name (allowing for common misspellings, abbreviations, etc.). This allows us to understand the four classic GSC metrics (clicks, impressions,CTR and position) in terms of branded vs non-branded traffic.

On top of that, besides simply adding calculated dimensions, having the Search Console and Analytics data stored in the same database allows us to synthesise the two, and one way we do this is by assigning a portion of the Google-organic revenue to each keyword (our “revenue-by-query” metric).

This requires applying a fair few “JOIN” operations to the tables in our database (a good basis in SQL is recommended if you want to get started with BigQuery!), but essentially we’re looking at each landing page and summing up the total organic revenue for that page (from Analytics) and the total clicks onto that landing page (from Search Console), and then estimating the total organic revenue for which that keyword was responsible.

Now our Search Console table has an additional metric associated with each keyword – organic revenue! Combining this with our “branded” dimension gives us additional insight that was completely impossible by simply looking at the Search Console or Analytics web interfaces.

The results

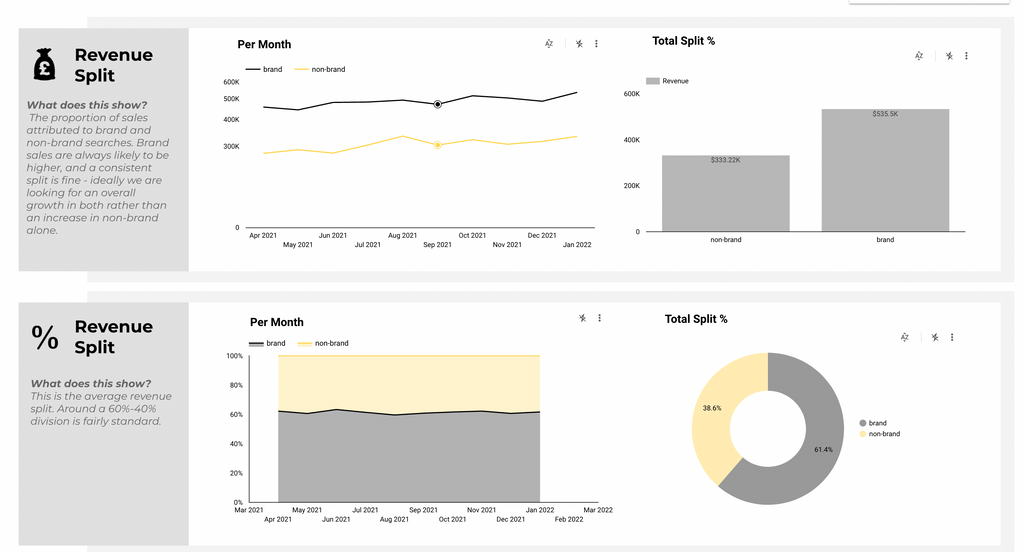

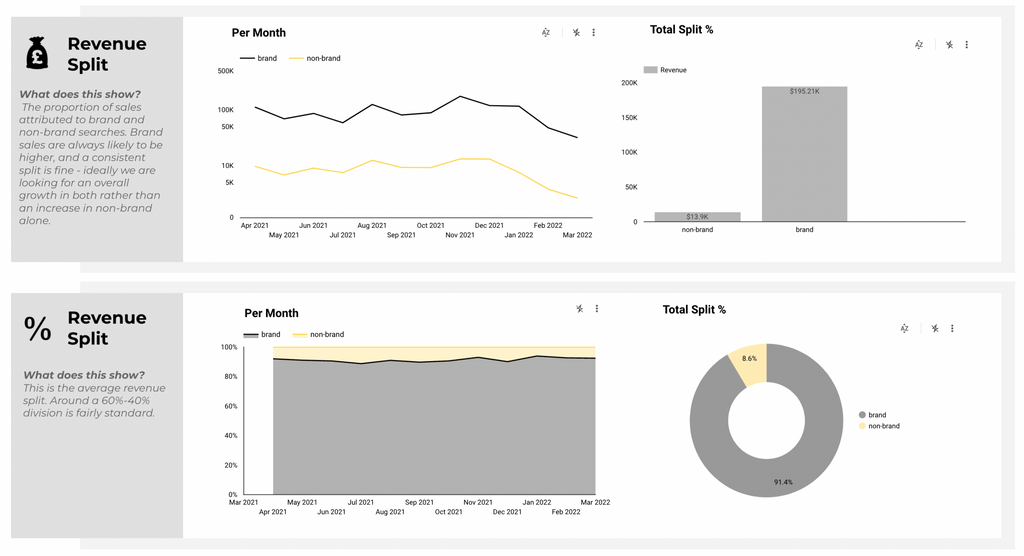

This process allows us to create reports like the one embedded below. It’s currently using example data – in this case from the fictional Dino Pet Shop – but clearly visible are both the trends and more granular breakdowns of how both brand and non-brand traffic are performing. This follows a fairly standard pattern of a roughly 60%-40% split in brand to non-brand revenue.

However, below are two screenshots from two very different live client projects. The first is an established DTC brand that sees almost 95% of sales from branded organic search terms. While in some instances this may be due to last click attribution, here this definitely isn’t the case – shifting to a first click rather than last click model only sees this figure fall marginally.

Of course this kind of brand recognition is great, but it shows that there’s an enormous amount of opportunity to grow the business through traffic using non-brand terms.

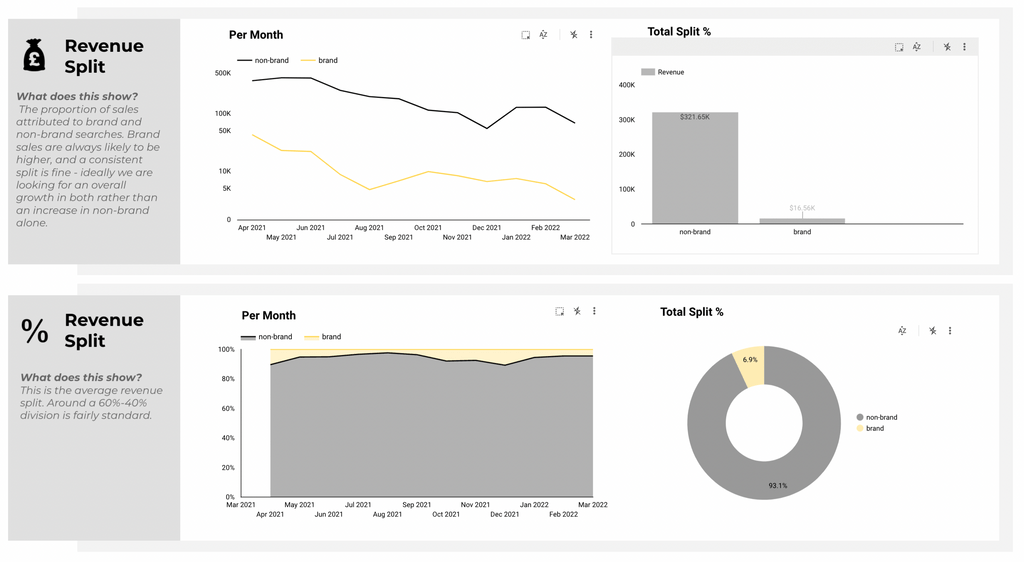

On the other hand, we can see a report for a multi-brand, multi-category retailer with around 6,000 products that estimates that 93% of revenue comes from non-brand terms.

This is great from an SEO point of view, but some brand visibility definitely wouldn’t go amiss – this kind of pattern means that there’s a lot of vulnerability to competition and pricing, for example.

Here we can see the value of this approach in action. Both of these projects require different strategies that would have been much harder to pin down without this kind of analysis. This means we can focus on work that will have the greatest impact instead of making assumptions based on guesswork.

Interested in seeing how one of our custom data reports could benefit your business? Sign up for one of our free data workshops and we’ll build a dashboard report showing the reasons behind any traffic or revenue declines your brand might be experiencing, and outline our strategy for regaining – and growing – both. Just fill out your details here, and we’ll be in touch.

Get in touch

Have a problem that Blink can help with? Let us know more about your project below and we’ll be in contact as soon as we can.